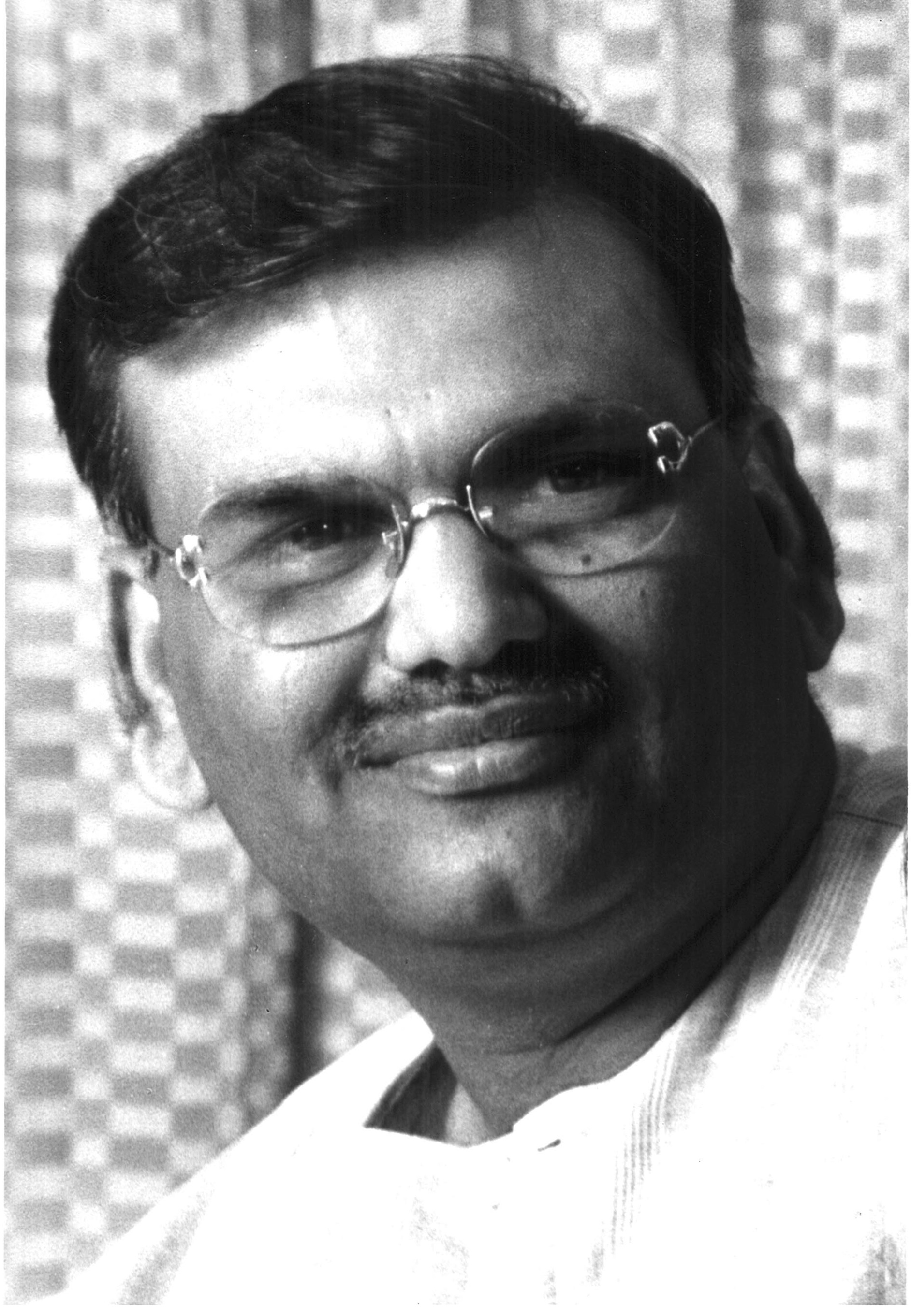

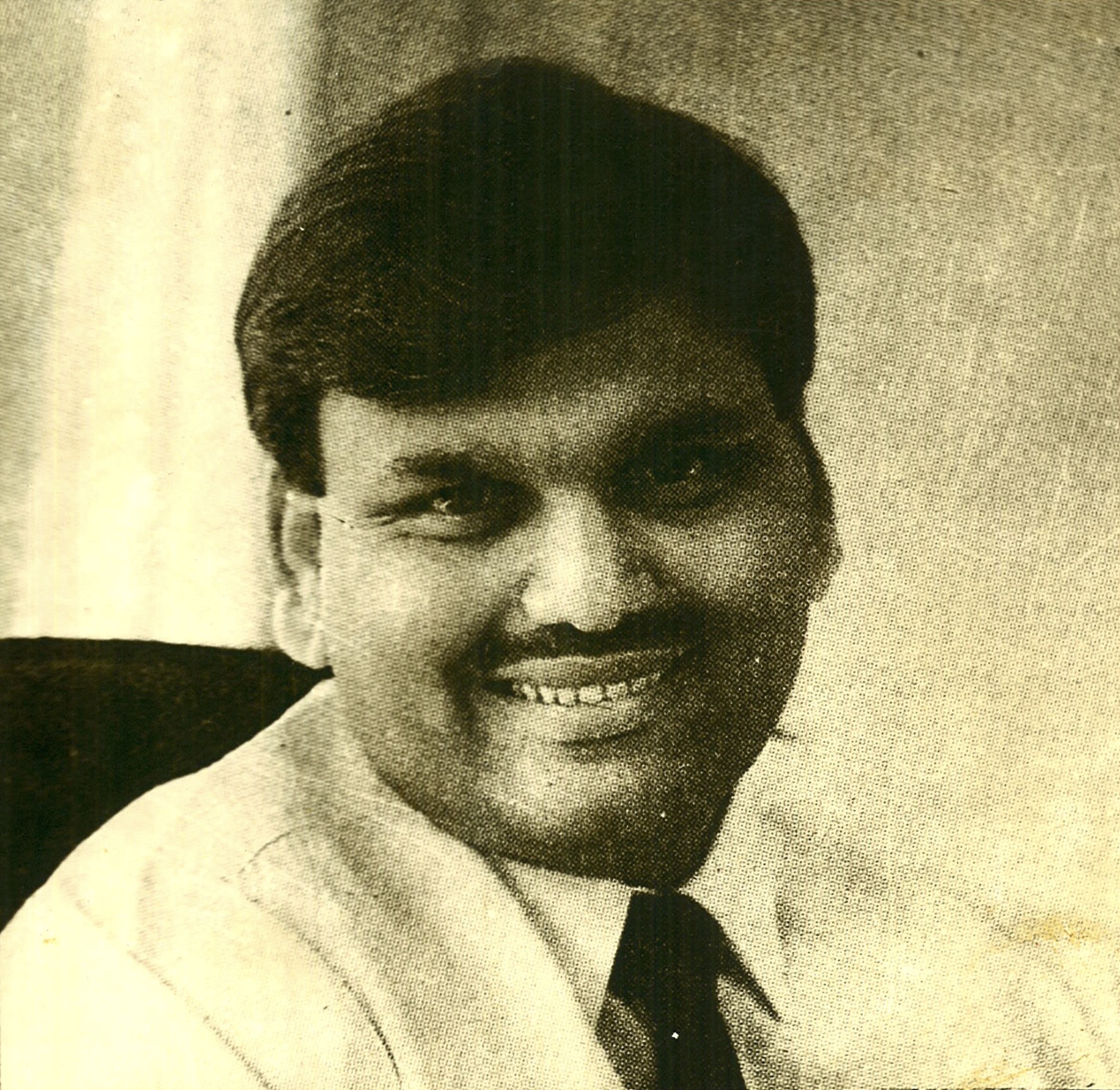

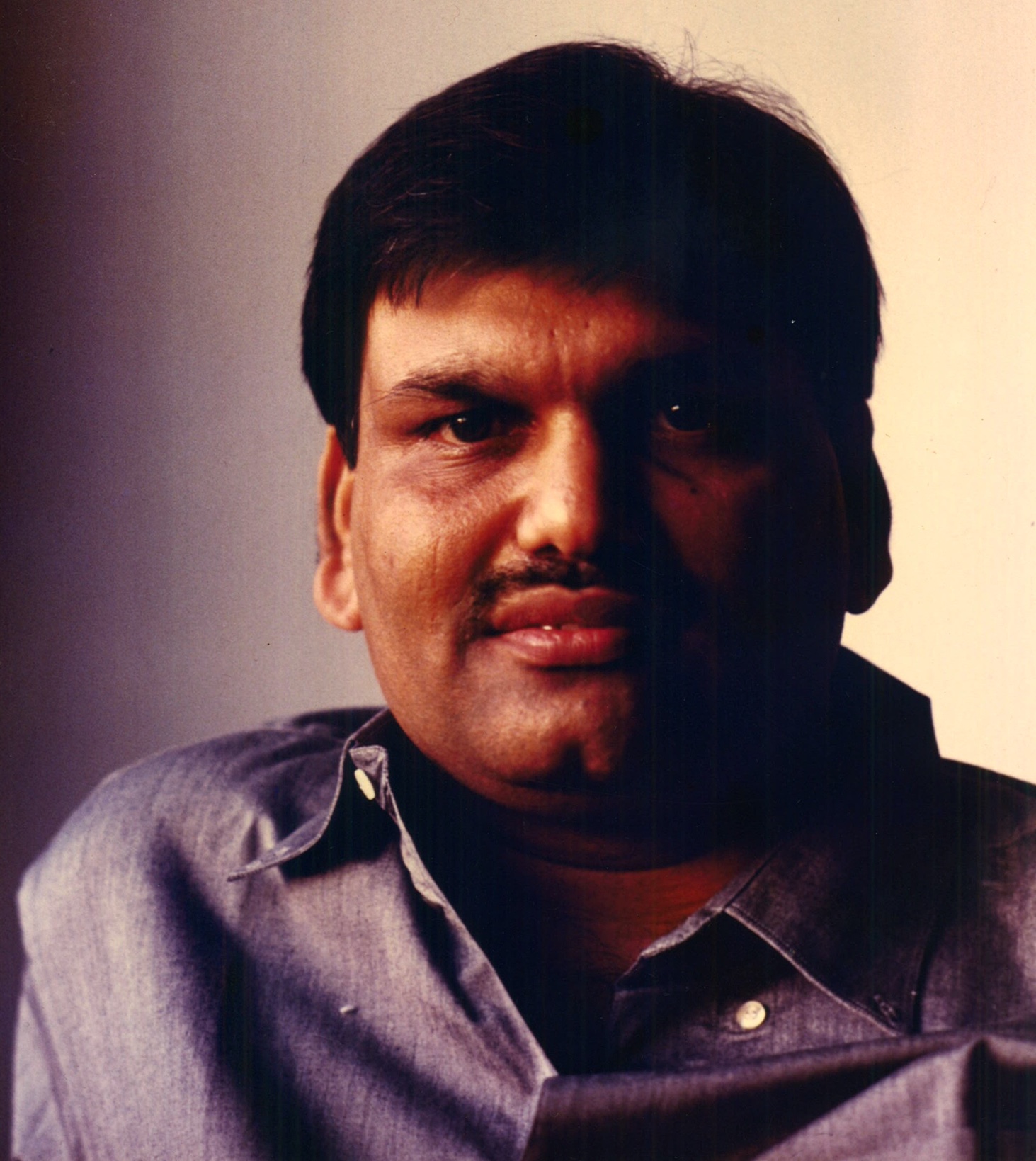

Smt. Jyoti Mehta Widow of Late Shri Harshad Mehta breaks silence after 20 years to posthumously defend her husband.

Learn More

WIDOW BREAKS HER SILENCE AFTER 20 YEARS

An Overview

Note: Smt Jyoti Mehta has spoken for the first time and narrated facts of more than 30 years duly supported by unimpeachable evidence most of which now stands conclusively established. This evidence is instantaneously available through the links which are highlighted in blue duly underlined. The proof is instantly available by pressing the highlighted portion. The documents are typed because of degeneration over passage of time, for better reading and to save time the relevant portions are also colour marked. However the original documents are available in the Downloads section.

She wanted to narrate every significant fact in the long journey and ordeal of 30 years and therefore the volume of facts and evidence is indeed substantial. Every endeavor is made to simplify complex facts and attempt is made to make the site very user-friendly. She humbly requests that if public could watch the web series on Harshad for 9 hours they may kindly peruse through the contents in the website painstakingly built by ensuring accuracy. It is hoped that the story is found instructive and hope it serves as an inspiration to anyone who is facing adversity.

It was almost past 11 p.m. on 30th December 2001 that lightning struck me when I was informed of the sudden and tragic death of my husband in Thane jail after 54 days of custody even though he was absolutely hale and hearty and was just 47 years of age with no prior medical history of any heart ailment. On that fateful day, the jail authorities neglected his genuine complaint for 4 precious hours after he suffered the first heart attack at around 7 p.m. He immediately reported the unusual pain to his younger brother Sudhir who was in the next cell from where he could hear Harshad but could not see him. The jail Doctors saw him but did not have any medicine for a heart attack. Harshad, therefore, requested them to give him Sorbitrate (medicine) which I had given at the time of his arrest 54 days ago in an emergency kit which was kept in jail custody. Due to his presence of mind, Harshad requested them to give him that Sorbitrate which kept him alive for about 4 hours. Unfortunately, thereafter the jail authorities did not use that golden time of 4 hours to shift him to a hospital which could have saved his life. Alas none of us were by his side in his last moments.

Only at 11 p.m., he was made to walk for a long distance to the Thane hospital where he immediately succumbed in a wheelchair after his cardiogram confirmed a massive second heart attack. We were later told that an inquiry was ordered by the authorities and even post-mortem was carried out but neither this Inquiry Report nor the post-mortem Report was provided to us despite our repeated requests. The above facts confirm that there was a gross neglect by the jail authorities in treating my husband in time and in fact Sudhir in the next cell was not even informed at 11 pm about the shifting of Harshad to the hospital and only the next morning he was told that his elder brother was no more. I and my family members reached Thane hospital only after he had already expired and learnt some facts from the Doctors who attended on him. We do not wish such punishment and the tragic death like this even for our enemies.

Before the cremation of Harshad which was carried out the next day, our family under the spiritual advice of our Pujya Gurudev took a decision not to complain and rake up the issue about the neglect of the jail authorities since it would not bring him back but the wounds are yet fresh and refuse to heal themselves despite the passage of 20 years since then and our entire family sorely misses him. In these 20 years, our family has observed silence and completely stayed away from the media by not making a single statement on any issue touching our lives and the huge litigation that has got thrusted upon us since then and also about our continued sufferings and group punishment being meted out to us by the authorities only because we are related to Harshad even though we have not violated any law of the land. The proximate cause appears to us to be the revelations Harshad was compelled to make in the year 1993 about his meeting with the then Hon’ble Prime Minister, Shri Narasimha Rao on 04.11.1991 which fateful day have changed our lives for ever. In fact, since 04.06.1992 Harshad withstood the intense pressure of investigation and questioning but never made any disclosure about the fact that he was summoned for a meeting by the Hon’ble Prime Minister on 04.11.1991 until June 1993 when the first Press Conference was organized because of dragging of Harshad by numerous agencies making baseless allegations on him with which he was just not concerned as he was being framed in several cases.

The assets of each and every family member and corporate entities promoted by us (Mehtas) have been brought under attachment now since past 30 years when the Custodian appointed under Section 3(2) of Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992 (Torts Act) a draconian statute, notified us through Gazette and attached our assets on 8.6.1992. This attachment roped in assets of several family members and corporate entities who were not concerned at all and there was a clear discrimination by the Custodian who has not followed the uniform policy as he has not notified family members and corporate entities while notifying several other persons. This notification has virtually paralyzed us and cast acute legal disability on all of us besides throwing all of us out of our business and income earning activities. For more than 2 decades we have lived without bank accounts. However, yet our family decided after sudden demise of Harshad to pay our homage to him i.e. to fulfil all his unfulfilled wishes the foremost being his strong wish to discharge all his obligations and clear his name as he was prevented from discharging them despite a number of efforts made by him and thereafter followed up by me, a list of which efforts is enclosed.

We feel aggrieved that our fundamental and other valuable constitutional and human rights have been suspended and grossly violated for past 30 years and our family is being meted out with a group punishment even though we have not undertaken a single transaction in securities with the banks nor any banks have lodged any claims on us. There is no allegation made for violation of any law of the land and even though the Torts Act does not provide for or support such a treatment of innocent persons but we have been marked and discriminated against and singled out by the political dispensation of that time. The Custodian has till date also not established any nexus or flow of any tainted monies to us as required in law and CBI even after combing through each and every transaction undertaken by Harshad and studying the flow of monies under these transactions has yet not cited any one of us as accused except the two younger brothers of Harshad which was for signing some documents as authorized signatories in his absence.

I therefore take this opportunity of sharing some facts relating to our sufferings since a huge curiosity exists about what has happened to the family after the sudden demise of Harshad on 30.12.2001. These 30 years have been a long and very difficult journey for Mehtas and it is not possible for me to narrate all the facts and events covering it. In fact I am also legally advised not to touch upon matters which are sub judice though so much litigation has enveloped our entire life.

Since Harshad was vilified through trial by media and which continues even till date by referring to him as a “scamster” even though he was not proved guilty of allegations made against him and therefore I am constrained and compelled to atleast posthumously defend him since the subsequent facts and events completely vindicates him of what he had stated and conclusively demolishes baseless allegations made against him by some vested interests. Since the media, movie and the web series has kept him alive, I consider it to be my duty to defend him posthumously since all the facts have emerged and already got established, discovered, proved and become unimpeachable and most of which are in the form of orders passed by Hon’ble Courts and Tribunals.

Harshad till his last breath had reposed complete faith in the judiciary of this country and never ran away from it as for 9 years even though he suffered huge humiliation and rebuke in the media and in Hon’ble Court which disbelieved him when he spoke as a result of which he virtually lived a life of ignominy. The attachment of our assets has deprived us from an opportunity to defend ourselves in a country where even Kasab who committed the crime in the open was given the legal support to defend his indefensible case.

It is ironic that the allegations of criminal offences were made by CBI which does not concern the Income Tax department but the “State” has used the I.T. department the most to foist upon us false, fabricated and patently illegal demands of about Rs.30,000 Crores spread over more than 2200 proceedings. The discretionary powers under the I.T. Act have been grossly abused to raise such preposterous demands assessing us by more than 100 to 300 times of our actual incomes. It must be noted that as per the CBDT Circular of 1969, the definition of ‘high-pitched demands’ is when income is assessed at twice the actual income. To determine such a high-level of income the department has treated either the turnover as taxable income or value of the investments as the income and made enormously large additions on the basis of presumptions, conjectures and surmises which are either not backed by any material or evidence or which additions in fact are contrary to the material and evidence on record. Yes, Mehtas had made long-term investments in several blue chip companies which appreciated more than 100 times but the liability to pay tax (rather long-term capital gains tax) would arise only if and when the shares were sold by Mehtas. There was no corresponding asset base found for the incomes for which we were assessed. The object of the I.T. department clearly has been to create a huge web of false cases and liabilities such that it denudes all of us of our assets, prevents us from discharging our genuine obligations, embroils us in completely avoidable litigation for decades and causes losses to us by premature and coercive sale of our assets and makes us bankrupt by lacing us with liability to pay interest at extremely high rates which keeps mounting by the day during this period of prolonged litigation. Thus from 1993 onwards we have become the biggest victims of the highest form of “tax terrorism”.

In support of my allegations, I am pleased to present the following table of reliefs secured by us in some of the largest cases by comparing the incomes as they were originally assessed with their present levels post reliefs:

ENTITY |

ASST. |

ASSESSED |

REVISED |

%AGE | |

Harshad Mehta |

1990-91 |

190,38,71,836 |

46,00,149 |

99.76 | |

Harshad Mehta |

1992-93 |

2014,04,65,298 |

0 |

100.00 | |

Harshad Mehta |

Block |

507,29,63,641 |

1,24,32,883 |

99.75 | |

Ashwin Mehta |

1991-92 |

30,76,95,636 |

0 |

100.00 | |

Ashwin Mehta |

1992-93 |

444,20,31,858 |

0 |

100.00 | |

Jyoti Mehta |

1991-92 |

4,55,96,656 |

1,22,10,415 |

73.22 | * |

Jyoti Mehta |

1992-93 |

405,31,74,850 |

32,54,186 |

99.92 | * |

Hitesh Mehta |

1992-93 |

20,38,95,716 |

3,62,50,724 |

82.22 | * |

Pratima Mehta |

1992-93 |

36,75,72,411 |

11,79,22,546 |

67.92 | * |

Rasila Mehta |

1992-93 |

23,43,22,140 |

3,33,44,326 |

85.77 | * |

Sudhir Mehta |

Block |

239,50,66,304 |

4,78,58,909 |

98.00 | * |

Growmore Research & Assets Management Ltd. |

1991-92 |

58,43,64,832 |

19,49,38,670 |

66.64 | * |

Growmore Leasing & Investments Ltd. |

1992-93 |

57,78,21,053 |

87,16,869 |

98.49 | * |

* In the cases marked asterisks further reliefs are yet expected.

To compound matters, despite the fact that we had done extremely well and were always solvent and capable to discharge all our obligations but in order to make Harshad a “scapegoat” and get the entire family entangled in prolonged litigation, the income tax has been given a priority over the claims of banks under section 11(2)(a) of the Torts Act even though this Act has been brought in to redress the grievance of the banks. The I.T. department has exploited to the hilt this priority in a manner that after foisting patently illegal claims the department has coercively and illegally secured release of monies against them before any monies could be paid to the banks. In fact, a major issue arose when banks complained that monies belonging to them and lying in the hands of Harshad were taken away by the I.T. department and therefore the Hon’ble Supreme Court had to intervene and lay down the law. After examining the constitutional validity of the Torts Act, the Hon’ble Supreme Court also framed 6 questions of law and answered them in favour of banks and against the I.T. department through a landmark judgment in the case of Harshad Shantilal Mehta Vs Custodian reported as (1998) 5 SCC 1 (hereinafter refererred to as Hashad Mehta’s Judgment). Unfortunately the law laid down by Hon’ble Supreme Court through the above judgment has been violated with impunity by the I.T. department and the Custodian acting in collusion with each other and the department has illegally secured release of Rs.3285.46 Crores, the entity and order-wise particulars of which are enclosed. The Torts Act a special statute has been subverted by the Custodian and the I.T. Department and they have jointly played a fraud on this statute in terms of the law laid down by Hon’ble Supreme Court as explained in State of Punjab vs Gurdial Singh reported as (1980) 2 SCC 471 paras 8-11, 16.

The assets belonging to M/s Harshad S Mehta were lying in several banks but they acted dishonestly and usurped them to give another challenge in litigation to recover them, many of which still remain pending to be recovered and this is despite the fact that Sec.3(3) of Torts Act provides for automatic attachment of all properties belonging to notified persons lying in the hands of third parties and huge powers are conferred in Custodian to trace and recover them. In fact, under the Torts Act it is the onus and obligation of such third parties to come forward and disclose and handover the attached property to the Custodian but yet because of gross and deliberate failures of the Custodian, such attached assets have not been recovered in several cases for past 30 years. So far as shares are concerned, vast quantities of unregistered shares were seized and large quantities also got out of the control atleast 4 months prior to the alleged scam since 28.02.1992 when a massive raid was carried out by the I.T. department but the same did not cover the main premises where shares were housed by Mehtas. The staff without being in touch with Mehtas decamped with the stock which was never brought back till the I.T. raid continued till 02.06.1992 whereafter within 2 days the male members in the Mehta family were arrested by CBI on 04.06.1992. The dividends, rights and bonus shares on Blue Chip investments have been paid over to lakhs of erstwhile shareholders who had already sold the shares and received payment for it but unfortunately due to several unforeseen events the unregistered shares could never get registered in the names of Mehtas.

The Custodian had a primary statutory duty to trace and recover our attached assets after our notification particularly because he opposed our every application seeking release of monies for payments to Counsels and Advocates whom we wanted to engage to contest the false claims as also to recover our attached assets. It is surprising that after obtaining orders from Hon’ble Special Court directing him to recover the shares and accruals from their erstwhile shareholders the Custodian has deliberately failed in causing such recoveries and not complied with the orders of Hon’ble Special Court passed from 1992 onwards and the value of assets which are pending recoveries run into thousands of crores.

The biggest problem we have faced is that the entire family’s assets got attached and despite our having huge surplus of assets we have not been released any monies to defend ourselves against the criminal charges, to contest false claims of Income Tax and banks nor to take steps to recover our attached assets lying with third parties including in cases where we find that the Custodian had deliberately not recovered the same despite orders passed by Hon’ble Special Court directing him to recover these assets. Our constitutional rights to be represented by Advocates of our choice have been repeatedly denied to us under false presumption that our liabilities are greater than assets and therefore we are using the monies which belong to our creditors. Such presumptions are made by assuming that all claims raised on us by the I.T. department are our crystallized liabilities are true despite the Hon’ble Supreme Court itself laying down the law that the disputed claims of the department until they become final and binding do not qualify to fall in the definition of “Taxes Due” as defined u/s 11(2)(a) of the Torts Act. It is ironical that Custodian has treated every demand of revenue as our liability despite our producing 1200 orders of relief wherein 98% of the additions have been deleted by the appellate authorities.

Further, such presumption is made by Custodian even after Hon’ble Special Court itself came to the conclusion that there was gross miscarriage of justice in the assessment of Harshad Mehta and it was found that his turnover was treated as his taxable income. I rely upon the order passed by Hon’ble Special Court on 29.09.2007 in Report 15 of 2006 where it is concluded that therewas gross miscarriage of justice, 92% of the income has been scaled down by Hon’ble Special Court. All the 4 applications filed by us in 1996, 2003, 2013 and in 2022 seeking release of monies have been rejected by Hon’ble Special Court on the basis of such false assets and liabilities picture presented by the Custodian before Hon’ble Special Court by grossly understating our assets and overstating our liabilities and this issue is further explained hereinafter.

Fortunately, one amongst us, Shri Ashwin Mehta had done law in 1979 and therefore obtained a license in 2013 after 34 years to appear as Advocate so that the massive damage we suffered after Harshad’s demise and complete breakdown has been partially repaired and we have recovered and for this we really thank the Almighty. Our attached assets continue to be mismanaged by the Custodian and we continue to discover his lapses and then take corrective steps. Custodian keeps filing false affidavits disclosing what stands recovered but suppressing the true status of pending compliance and recovery which suppression is then unearthed by us to his displeasure by regularly seeking disclosure and status by addressing letters, by filing applications under the RTI Act and by filing applications before Hon’ble Special Court to seek relief of inspection of records, disclosure of facts and evidence in possession of Custodian and the status of compliance. In fact I have enclosed copies of several false affidavits filed by the Custodian till date.

All this has foisted upon us completely avoidable additional burden of keeping a constant watch on the performance of the Custodian and every step we take for that makes us further unpopular in the system. In fact for several years and almost until 2006 I was under a bona fide belief that the Custodian being officer of the Court would be discharging his statutory duties in accordance with law but we were aghast to progressively discover the gross mismanagement of our attached assets. Worst still he kept us completely in the dark and as a result Harshad and almost all of us went unrepresented for several years and even today we are not able to effectively defend ourselves which has caused irreparable damage and losses to us. In fact, the sudden demise of Harshad led to a complete breakdown as I being a housewife and due to my poor health could not defend him or myself besides the fact that even I am a notified person and even my assets have been under the attachment since 08.06.1992.

After suffering both long widowhood and attachment of her assets for almost 30 years our mother Smt Rasila Mehta passed away on 26.04.2020 at the age of 84 years without getting justice since her crucial Civil Appeals have not been heard by the Hon'ble Supreme Court from 2011 onwards even though as a very senior citizen she was entitled to an urgent hearing. She filed 2 Applications to seek early justice while she was alive and they were granted but yet very unfortunately her Appeals could not be heard for one reason or the other. Unfortunately, even a small portion of her shareholdings in Hero Honda purchased well before the alleged scam of 1991-92 and which had no nexus with any funds belonging to banks were not released to her though they were sought to meet her medical expenses due to her repeated hospitalization and other obligations which she wanted to discharge in her lifetime. The recent Application to defend her estate has also been rejected. Notwithstanding above, the past 20 years post Harshad’s demise have also been extremely trying as we made herculean efforts to survive and turn around the situation, a complete account of which is now given to all of you.

The breakdown post Harshad’s demise was fully exploited both by the Income Tax department and the banks who foisted upon Harshad and the rest of us patently false and illegal claims and the banks secured ex-parte decrees against the estate of Harshad for much higher amounts and in some cases where no amounts were not payable at all . The Custodian did not contest the false claims but instead took advantage of our condition and colluded with the IT department and the banks in several ways. Much before the claims against us got finalised and knowing fully well that they were false and highly exaggerated but the Custodian yet supported and secured the release of Rs.3285.46 Crores in favour of the IT department and Rs.1716.07 Crores in favour of the banks and thereby fully met the entire demands of tax and the entire principal sum of the decrees obtained by the banks. To confer benefits on them the Custodian violated the law laid down by Hon’ble Supreme Court in the case of Harshad Shantilal Mehta vs. Custodian reported (1998) 5 SCC 1 (hereinafter referred to as Harshad Mehta’s judgment) which violations are explained hereinafter. To meet these patently illegal demands, the Custodian prematurely sold our appreciating Blue Chip shares at throwaway prices and thereby inflicted upon us huge losses of Rs.20,677.28 Crores the details of above losses are provided in the enclosed chart.

The Custodian has also caused us losses by deliberately not recovering our attached assets from banks and third parties valued at more than Rs.5,000 Crores and which included several cases where the Hon’ble Courts have already directed him to recover these assets and several orders remain pending to be complied with by the Custodian for past 25/30 years. The Custodian is governed by two ulterior objects being one to hurt us by conferring favours on to several third parties using our assets and second to create a huge hole in our assets and then falsely canvass that our liabilities exceed assets. From 2006 onwards when we discovered the failures of Custodian and exposed his illegal conduct he has started acting more revengefully against us. The Custodian has also discriminated against us as in the case of other notified entities, he has been recovering their attached assets of even a few lakhs but in our case not recovering our attached assets of thousands of crores and a chart is enclosed in respect of others. We also have large recoveries of shares and accruals from other notified entities which is the simplest task as it involves the transfer of shares and monies from other notified entities to us both of whom are within his control but yet in 10 cases even such recoveries amounting to Rs. 427.58 Crores have deliberately not been caused by the Custodian which conclusively establishes our above allegations. In fact our shares are sold in their hands and monies have been used to discharge the liabilities of other notified entities and details of pending recoveries are provided in enclosed chart.

Since Harshad offered to unconditionally meet all his obligations in 1992 itself and consequently all of us would have been left with surplus assets in our hands, and therefore in order to prevent us from coming back to the market, the false claims have been foisted upon us to entangle us in prolonged litigation which mala fide object the department has achieved very successfully for 3 decades. The Central Board of Direct Taxes (CBDT) and the department in several of their Circulars have already admitted to the existence of such pernicious practise of the department to raise false demands and thereafter take coercive steps to recover monies against such illegal demands but in our case, the IT department has gone to extreme levels. After Harshad’s demise and suffering 3 rounds of illegal assessments we have already won more than 1200 large cases and brought down the illegal demands from Rs.30,000 Crores to about Rs.4000 Crores and also secured refunds to Custodian of Rs. 814.33 Crores and further refunds of about Rs.5,500 Crores are already overdue and not being made by the IT department. When the balance appeals are heard the claims of revenue are expected to fall to about Rs.200 Crores and will entail further refunds. Thus, we have thwarted the plan of the I.T. department and Custodian to usurp Rs.3,285.46 Crores released to them by completely paralyzing our organization and hurting our ability to defend ourselves though at one point after Harshad’s demise this plan had already succeeded. In the process irreparable loss of Rs.20,677.28 Crores is already suffered by us.

The IT department has a reputation of acting as an adversary of the assessees and therefore the present Government has advised the Assessing Officers (AOs) not to harass the assessees. The department during their raid carried out on us on 28.02.1992 seized vast quantities of our computer data and records and on which basis it made some provisional assessment of taxable incomes earned by us. Since our family was already facing difficulties because of massive adverse reports in media, seizure of our bank accounts and suspension of our 3 brokerage firms in the middle of May 1992 and reports of likely investigation against Harshad by CBI we decided to buy peace with the department and on 02.06.1992 made a declaration of income u/s 132(4) of the IT Act of Rs.100 Crores duly clarifying that no incomes were earned outside of books of accounts and this declaration was the highest-ever declaration of income till that date. The IT department was extremely happy with this declaration as it was reportedly higher than their provisional assessments of our income. We made the above declaration even though our business had come to a complete halt due to all the above unforeseen events.

Thereafter within 4 days on 6/6/1992, the Government promulgated by way of an Ordinance Torts Act and u/s 11(2)(a) of this Act the IT department was given a priority for recovery of its dues over the banks and other creditors. It is then that the IT department planned to take full advantage of the priority accorded to it and take away all the attached monies and assets lying in the hands of Custodian completely unmindful of the fact that the same would defeat the objects of the Torts Act which was brought about as a Special Statute to protect the interest of banks. From 1993 onwards, the department started making high-pitched assessments and pressed for the release of monies against these demands. The Hon’ble Special Court noticed this conduct of the department and made strong observations against it in its order dated 02.07.1993 in MA 107 of 1993 criticizing it.

Despite the adverse observations and instead of making amends the IT department acted with vengeance and between 1993 to 1996 assessed abnormally high incomes in case of all Mehtas which on the face of it could not have been earned by any one of us as the incomes were assessed more than 100 to 300 times of the actual taxable incomes. I am pleased to enclose charts giving the particulars of income assessed for 6 years for individuals and 5 years for companies. In support of my allegations about the falsity of the assessments I am also pleased to enclose a few charts as samples wherein the Appellate Authorities have deleted the false additions upto 99%. It can be seen that against the declaration of income of Rs.100 Crores based on the same seized material and records the department assessed incomes of Rs.5604.92 Crores in the case of 9 individuals and Rs.556.80 Crores in case of the corporate entities. In order to determine our true asset and liability picture the Hon'ble Special Court in 1993 also appointed 3 reputed firms of Chartered Accountants to draw our books of accounts and audit them for the crucial period between 1990 and 1993 and had empowered these Chartered Accountants to verify each and every transaction with the third parties. The books of accounts were drawn by us and placed before these Chartered Accountants who thoroughly verified them. In support of my allegations I am pleased to enclose a chart which gives a comparison between the incomes disclosed in the books of accounts and the incomes assessed by the IT department for Assessment Years 1992-93 and 1993-94 to show how patently illegal the assessments were framed by the department. The Custodian by his illegal conduct has already achieved his mala fide objects of persecuting us and ensured the continuance of his office for past 30 years.

Thereafter when we secured reliefs from Hon’ble CIT(Appeals) and Hon’ble Income Tax Appellate Tribunal (ITAT) under more than 1200 orders, the reliefs granted therein have been completely denied to us by the department through several illegal and high-handed methods (a list of which is enclosed). So much so that for 12 years 90 orders passed by Hon'ble ITAT directing the AO to assess our incomes based on our books of accounts and after giving us a proper opportunity, the same were not complied with by the AO. To save our residential premises ordered to be sold for the third time we placed the above facts before Hon’ble Supreme Court who was pleased to intervene and pass orders on 02.05.2017 and 08.05.2017 in Civil Appeal 6326 of 2010 directing the tax authorities to comply with the above 90 orders in 12 weeks but even the orders of Hon’ble Supreme Court have not been complied with by the department for past 5 years. In some of our largest cases, we thereafter made a grievance before Hon'ble ITAT who were pleased to hear our appeals and grant us reliefs under a combined order dated 14.01.2019, the particulars of which are provided in a summary chart together with 4 enclosed charts. The above landmark order settled long pending disputes and sharply turned around our situation. The Hon’ble ITAT is the last fact finding body and the above reliefs came to be granted because the additions were patently illegal, high-pitched and not backed by any material and largest additions were deleted in compliance with the law laid down by Hon’ble Supreme Court in the case of DCIT Vs SBI reported as (2009) 2 SCC 451. The two largest assessment orders in case of Harshad and Ashwin for AY 1992-93 have already been quashed since they were illegally framed.

After seeing the conduct of the IT department and in order to resolve the conflict between the competing demands of Income Tax and the banks on the funds attached by the Custodian, the Hon’ble Special Court framed 3 questions of law and answered them through its judgment and order dated 20.02.1995 in MA 107 of 1993 (Para 98 onwards). The Hon’ble Special Court held that once a person is notified and has adequate assets then no interest or penalty is leviable on him due to the legal disability cast upon him by attachment of his assets. This judgment was then challenged before the Hon’ble Supreme Court by the banks, IT department, notified persons and the Custodian and even the constitutional validity of the provisions of the Torts Act was challenged by Standard Chartered Bank because according to them the monies belonging to them and lying in the hands of notified persons duly attached by the Custodian were taken away by the department by raising illegal demands. The Hon’ble Supreme Court framed 6 questions of law and also examined the constitutional validity of the provisions of the Torts Act and answered them through a landmark Harshad Mehta’s judgment. However and unfortunately the law laid down in the above judgment has been grossly violated by the IT department, banks and the Custodian all acting in collusion with each other and these gross violations are explained below:

The conflict between the claims of the IT department and banks was resolved in favour of the banks by giving primacy to the objects of the Torts Act and interpreting the phrase “Taxes Due” strictly as used in Section 11(2)(a) and giving complete discretionary powers to the Special Court to decide the amounts that could be paid to the department (Paras 26, 28, 29 and 34). Despite the above, all the organs of the State acting in collusion have secured the release of vast amounts as already explained. This is done by taking away the assets and monies belonging to Mehtas to meet false and illegal claims on Harshad.

The phrase “Taxes Due” was defined strictly to include only those demands of the IT department which were legal and which had become final and binding until which time no monies were liable to be released to the department (Paras 23 and 24). Yet above large amounts were released which are now refundable with interest. Thus no amounts were liable to be released to the department in the first place and now the same are not being refunded by it.

The priority u/s 11(2)(a) was in respect of only those demands covering the statutory period of the Torts Act being 01.04.1991 to 06.06.1992 (Paras 25, 26 and 37). Only claims for Assessment Year 1992-93 fell in priority but yet even tax demands of Assessment Year 1993-94 amounting to Rs.1038.59 Crores are recovered.

It was expressly laid down that claims of creditors can be met by the Custodian and Hon’ble Special Court only when the ‘date of distribution’ arrives which arrives after examination of all claims by and against notified persons u/s 9A of the Act are complete (Para 27). Unless a full and proper picture of assets and liabilities emerge a fair distribution cannot take place but yet large amounts were released to the IT department and banks on adhoc basis by prematurely selling the assets causing huge losses and now monies are not being brought back by the department. Instead of recovering Rs.193.71 Crores back from the department as ordered in Para 39 of Harshad Mehta’s judgment, several thousand crores were further released to the IT department.

Law was laid down that liability to pay tax should be determined under the Income Tax Act and the Special Court cannot sit in appeal over the same but full powers were given to it to decide how much amount should be paid to the department (Paras 28 to 36) and yet 100% of the disputed demands of tax have been fully met thereby defeating the primary objects of the Torts Act. Such discretion was exercisable by taking several factors into account. The Hon’ble Special Court examined the assessment orders against Harshad and concluded under order dated 29.09.2007 in Report 15 of 2006 that there was a gross miscarriage of justice in Harshad’s assessments. This order upon challenge was largely upheld by Hon’ble Supreme Court under their judgment in the case of DCIT vs. SBI reported as (2009) 2 SCC 451 wherein the banks and the department were directed to prove their contentions in 3 months but now for the past 13 years this judgment and the directions given therein are not complied with. Without complying with the directions, the Hon’ble Special Court has fully met the entire demand for tax.

That despite above, the Hon’ble Special Court by an order dated 25.02.2011 passed in Report 9 of 2010 directed to make payment to the IT department of Rs.1995.67 Crores and Rs.225 Crores to banks and further directed to transfer large amounts of Rs.1808.27 Crores lying in the accounts of Mehtas to the account of Harshad to meet claims against him and particulars of amount transferred are enclosed.

Law was also laid down that the Special Court cannot absolve a notified person from levy of penalty or interest by the IT department and granted a remedy to the notified entities to seek its waiver under the Income Tax Act. It laid down that the claims of the IT department for interest and penalty post statutory period of the Torts Act of 01.04.1991 to 06.06.1992 are not covered under the Act. The Special Court has full discretion to meet claims of interest and penalty only if there is a surplus left with the Custodian after meeting priority claims (Para 38). Custodian acting illegally is still presenting a false picture of our liabilities by including interest and penalty in them even before the Hon’ble Special Court exercises and even we avail the remedy given to us by Hon’ble Supreme Court. In fact the Hon’ble Supreme Court has directed and further delivered their judgment on 09.04.2019 in the case of Gurukripa Trust, copy of which is enclosed.

Law is laid down that liability of a notified person should be met out of his own assets and monies and assets of any other person cannot be used for meeting the same. It was clearly held that otherwise, the Torts Act will have to be held constitutionally invalid. The banks were given remedy to establish their claims on the attached assets in accordance with law (Refer Paras 11 to 15, 17, 18 and 41). In gross violation of above the Custodian, IT department and banks acting in collusion with each other have canvassed that all Mehtas should be treated as ‘one entity’ as “Harshad Mehta Group” and assets of all the entities should be used to discharge the liabilities of Harshad and in this manner more than Rs.2500 Crores are already transferred from the accounts of Mehtas to the account of Harshad and thereafter used to make payments to the IT department and the banks. The Custodian and the Hon’ble Special Court have sold our blue-chip shares at throw-away prices causing huge losses to us which cannot be recouped now even if monies are refunded by the IT department and banks.

In violation of Harshad Mehta’s judgment, now for more than 2 decades, the Custodian has been presenting completely false assets and liabilities picture by understating our assets and by overstating our liabilities by including the high-pitched and illegal demands of the IT department in our liabilities even though they have not become final and binding and even though claims for interest and penalty are not covered under the Torts Act. This is done with the mala-fide intent to false canvass that our liabilities are far greater than our assets and in order to somehow create a justification for taking coercive steps against us. This is done by overruling our protest and even after we have conclusively established the illegality and falsity of the demands of the IT department. This is singularly responsible for causing us huge losses by selling our shares. Acting contrary to the objects of the Torts Act, the Custodian has promoted the interest of the IT department at our cost and after causing such losses the Custodian has illegally canvassed the Harshad Mehta Group theory to take away our surplus assets to meet the false claims on Harshad.

In violation of the above law and even before the demands and claims attained finality the Custodian got approved a scheme governing the sale of shares and urged that the shares belonging to notified entities can and should be sold and urged that the sale proceeds may be paid over to the IT department even against disputed and illegal claims. Against all canons of law, it was canvassed that shares may be sold even if there are no liabilities to be met and the scheme was approved under the order of Hon’ble Special Court dated 17.08.2000 in MP 64 of 1998 and later upheld with some modifications by Hon’ble Supreme Court under order dated 23.08.2001 in Civil Appeal 7629 of 1999. That all valid objections raised by us both against the scheme and sale were overruled and the shares were sold at throw-away prices offering deep discounts causing huge losses to us. In fact, the shares of ACC and Apollo Tyres in which our holdings constituted “Controlling Block” of shares and which were already commanding huge premiums were sold at a deep discount. The shares of Apollo Tyres were offered to the management of the company who bought it at Rs.90/- per share when the ruling market price was Rs.120/- per share. Similarly, shares of ACC were sold at Rs.170/- to LIC when the market price was about Rs.210/- per share.

Upon challenge, the sale of shares of Apollo Tyres was partially set aside by the Hon'ble Supreme Court through their judgment in the case of Ashwin S. Mehta Vs Union of India reported as (2012) 1 SCC 83. The Hon’ble Court concluded that the shares were sold by the Special Court in violation of both the principles of natural justice and the scheme governing the sale of shares as we should have been granted an opportunity to bring a better offer as prayed for by us. Despite holding that the entire sale was liable to be set aside but only 1/3rd of the shares in existence i.e. 1.79 Crore shares of Rs.1/- f.v. have been recovered with dividends and we are pursuing the recovery of balance 3.69 Crore shares of Apollo of Rs.1/- f.v. Upon our complaint, SEBI has passed 2 orders on 09.07.2014 and 22.11.2018 concluding that Apollo Tyres had violated the Regulations governing Buyback of shares and the matter is now pending before Securities Appellate Tribunal (SAT). All orders are enclosed.

Due to our relentless efforts, we have already secured refunds of Rs.814.33 Crores paid by the IT department to the Custodian but about Rs.5500 Crores are yet not being refunded and the Custodian is also not securing these refunds both to confer a favour on the department and to understate our assets. Now for the past 4 years, the IT department is not even presenting the updated picture of its demands even after 19 letters are addressed by the Custodian to it just to create a record.

In terms of law laid down in Paras 11 to 15, 17 and 18 the assets of notified person alone can be used to discharge his liabilities and except Sec.4(1) which can be invoked by the Custodian there is no provision under the Torts Act under which the right, title and interest of a third party can be extinguished. The proposal of the Custodian to use the assets of family members and corporate entities to discharge the liabilities of Harshad is violative of the law laid down in the above judgment and therefore the Harshad Mehta Group theory is completely illegal.

However, by presenting a completely false liabilities picture, the Custodian has sold all our offices and we were asked by letter dated 14.05.2004 to vacate them in 48 hours so as to break and paralyze our organization. To uproot our family, the Custodian immediately after Harshad Mehta’s judgment filed MP 41 of 1999 seeking the sale of our only residential flats at Madhuli which Petition was vigorously pursued by him for 18 years and because of misrepresentations made by him, our residential flats were sold 3 times by Hon’ble Special Court under orders dated 17.10.2003, 25.07.2008 and 30.04.2010 all of which were quashed and set aside by Hon’ble Supreme Court upon our challenge under their following judgments and orders, copies of which are enclosed:

Ashwin S. Mehta Vs Custodian reported as (2006) 2 SCC 385.

Jyoti Harshad Mehta Vs Custodian reported as (2009) 10 SCC 564.

Order dated 02.05.2017 in Civil Appeal No.6326 of 2010, further modified on 08.05.2017.

Ours must be the only case in the Indian history where the same Ld. Judge ordered sale of our residential flats at Madhuli Apartments for 3 times and God Almighty saved us through Hon’ble Supreme Court on all the 3 occasions. But for our relentless efforts in contesting false claims and recovery of our attached assets our family would have been on the roads. However, we lament that the above victories came with a huge cost as our offices and shares were sold causing huge losses and saving our residence is a very little consolation in our overall sufferings.

Group punishment is violative of our fundamental rights under the Constitution, our other constitutional and human rights, provisions of the Torts Act, the Income Tax Act, the Civil Procedure Code and the binding law laid down under all the above statutes by Hon’ble Supreme Court and even the terms of the decrees obtained by the banks.

The Custodian under the Torts Act has a statutory duty to preserve and recover our assets but has completely abandoned his statutory duties under the Act and instead has stepped into the shoes of the creditors to seek and secure for them what they were not entitled to and at the same time achieved several of his ulterior objects. The Custodian has sought maximization of assets under his management which is achieved by abusing the powers of notification, by notifying all the Mehtas and thereafter perpetuating their notification. The vast asset base has then been used to confer huge benefits on the IT department, the banks and several third parties. Litigation has been promoted to perpetuate attachment of our assets and at the same time ensure the continuation of his office. After inviting claims against us in the year 2005 in order to make final distribution amongst our creditors and after seeing that virtually no claims were received against the family members and the corporate entities the Custodian unilaterally decided to canvass the aforesaid Harshad Mehta Group theory though the same had no basis in law and facts. Custodian filed a Report dated 12.08.2005 urging that the final distribution u/s 11(2) of the Torts Act can be undertaken in respect of 60 notified entities including all the Mehtas and secured on that basis secured an order from Hon’ble Special Court on 05.09.2005 and invited claims through Public Notice dated 19.10.2005. After seeing that no claims from banks were received against the family members and the corporate entities the custodian illegally propounded the “Harshad Mehta Group Theory”.

Under the Income Tax Act, there is no provision to recover dues of “A” from “B” even if “B” is related to “A” unless it establishes that “B” owes money to “A”. That despite being given a remedy under Para 41 of Harshad Mehta’s judgment, the banks have not lodged any claims on the assets of family members and corporate entities but in fact have obtained ex-parte decrees only against the estate of Harshad expressly stating that the legal heirs, Smt Rasila S. Mehta (mother), Shri Aatur Mehta (son) and I were joined as parties and we would be liable for the decree on Harshad only to the extent of inheritance received by us. That both mother and son have not made any claim on the estate of Harshad and I have not received any inheritance from Harshad except a huge amount of litigation but despite above the Custodian acting in collusion with the IT department and the banks have canvassed that we should all be treated as ‘one entity’ under the ‘Harshad Mehta Group’ theory and on that basis got transferred huge amounts of about Rs.2500 Crores from our accounts to the account of Harshad and used them to meet claims on him of IT department and banks even though his assets were more than sufficient to meet all valid claims. The copies of ex-parte decrees are enclosed wherein it is clearly stated that monies are payable to banks from the estate of late Shri Harshad Mehta.

That Custodian, IT department, NHB, SBI and its subsidiaries fall in the definition of ‘State’ as defined under Article 12 of the Constitution of India and therefore are required to act legally, fairly and in a non-discriminatory manner but in the case of Mehtas they have been unitedly acting illegally, unfairly, high-handedly and have also discriminated against us in several ways and thereby violated our fundamental rights guaranteed to us under Articles 14, 19 and 21 of the Constitution which are sacrosanct. Besides above, they have also violated our other valuable constitutional and human rights. Article 265 of the Constitution lays down that “taxes not to be imposed say by the authority of law. No tax shall be levied or collected except by authority of law" but yet against our liability to pay the tax of about Rs.200 Crores the IT department levied taxes, interest and penalty on us of about Rs.30,000 Crores and thereafter illegally recovered from us huge amounts of Rs.3285.46 Crores in complete violation of Harshad Mehta’s judgment and now for past several years illegally retained the amounts by not making the refunds of thousands of crores in gross violation of the Torts Act and the Income Tax Act and even undertakings executed by it before Hon’ble Courts to unconditionally bring the amounts back with interest as and when ordered to do so. Since false additions against us were deleted by the appellate authorities, the department had a duty to refund the above amounts even without being ordered to do so both under the Torts Act and Sec.240 of the Income Tax Act and as per several Circulars issued by the Central Board of Direct Taxes (CBDT) copies of which are enclosed.

Article 300A of the Constitution provides that “persons not to be deprived of property save by authority of law”. We are aggrieved that even though we had no obligation to meet the claims on Harshad, the Custodian, IT department and the banks have taken away more than Rs.2500 Crores from us only to persecute us. The Custodian is neither securing refunds from the IT department belonging to Harshad nor recovering his attached assets. Besides above, Sections 50 and 52 of the Civil Procedure Code lays down that legal heirs are liable only to the extent of inheritance received by them but yet assets of late Smt Rasila Mehta and my assets have been used to discharge claims against Harshad.

We have already established that each one of us have a surplus of assets and that even Harshad has adequate assets to meet all the genuine claims on him and therefore the family members and the corporate entities are liable to be denotified and their assets can be released from attachment. The Hon’ble Special Court appointed 3 firms of Chartered Accountants under combined orders dated 03.08.1993 and 03.02.1994 to draw the books of account and carry out verification of the transactions. Since the Chartered Accountants failed, we prepared and provided our books of accounts to the 3 firms of Chartered Accountants appointed by the Hon’ble Special Court for verification and disclosed the taxable incomes earned by us but the Custodian and the IT department working hand-in-glove are not examining these books of accounts at all. The Custodian himself has presented facts that M/s. Harshad S. Mehta has given loans to the family members of only Rs.16.07 Crores and yet instead of recovering these loans as directed by the Hon’ble Supreme Court he has taken away more than Rs.3000 Crores from the family members and corporate entities.

We are aggrieved that though Harshad was not proved guilty by the CBI of allegations made against him but even after 2 decades of his demise, Harshad is referred to by the media and in the movies as a “scamster” who defrauded the banks by about Rs.5000 Crores. This is even though not a penny is now owed to the banks since Rs.1716.07 Crores the principal amount of the decrees are fully paid and even though these decrees are still under challenge. Harshad’s assets are lying with several banks including SBI, SBI Capital Markets and NHB as only some of them have been recovered till date. Each and every bank after April 1992 have dishonestly sought to usurp the attached assets and monies belonging to Harshad Mehta and the Special Court have already given adverse findings against all the leading banks including Citibank, Standard Chartered Bank, SBI and SBI Caps, Canfina, PNB Capital Markets and PNB Mutual Fund whose orders are enclosed by me in support of my allegations and for ease of reference I am enclosing a list of all such orders which list is not exhaustive.

The allegations on Harshad that both the economy and the small investors suffered hugely are equally false as he became a victim of trial by media. In most difficult times Harshad never ever thought of leaving the country and till his death reposed faith in the judiciary and without being proved guilty received the highest punishment of death in jail at 47 years of age. I have at length dealt with all allegations against Harshad in this website. His name and his story have been commercially exploited through the web series and a movie though they are not founded on facts. Albeit I and my family members were surprised by the success of the web series as even though no verification of facts was carried out with us nor our consent obtained and despite false contents, yet the public has liked Harshad and his story in the web series for which I can only thank God for giving him justice in the public. I am therefore defending Harshad by presenting the true facts along with irrefutable evidence.

The Sucheta story as published in the newspapers and later followed up through her book is completely false. The news article written by her for the Times of India published on 23.04.1992 was malicious and motivated by a mala fide object to finish Harshad and his reputation and business and the article was libellous. Sucheta had no courage to name Harshad and therefore referred to him as “Big Bull” as he was widely known then. She knew very well and has already admitted that her source was the gossip of an ex-employee of SBI received by her only on 22.04.1992 and on the same day she verified her story with Shri M.N. Goiporia, Chairman of SBI as also Shri C.L. Khemani, the Dy. General Manager of SBI, both of whom clearly denied that there was any outstanding of Rs.500 Crores from Harshad which required squaring up. Sucheta yet mischievously presented the headline story of reconciliation and squaring up between Big Bull and SBI and gave it a false colour of criminality. She knew the facts and which are also admitted in her book that by 22.04.1992 and within 4 working days Harshad had already paid an amount of Rs.616.17 Crores to SBI as demanded of him and therefore there was no dispute or any foul intent of Harshad to cheat or hurt SBI. Harshad had duly explained to SBI that his business was deeply affected by a raid conducted by the IT department on 28.02.1992 under which all his computers and other records were seized. He explained that securities in several transactions were receivable by his firm and since the raid would continue for 90 days he could not collect or deliver the securities as they could get seized by the department and permanently affect the transaction. Ms. Sucheta Dalal followed by other journalists portrayed a picture as if some major crime and a huge scam was committed without verifying that before 23.04.1992 in the money market every participant had always fulfilled all their obligations. Her motive was to paralyze the business of Harshad by painting him as a criminal and such deep was the impact of the articles that the entire money market virtually came to a halt and all pending transactions were deeply affected. In a market that was driven by trust, so much chaos was caused that all the leading players did not honour their transactions post 23.04.1992 since everybody was affected.

In order to clear his name and arrest losses to the investors and since he had no motive to defraud any banks, Harshad took the following steps:

On 17.05.1992 he issued a Press Release to clarify that since allegations of huge losses to the banks were being made, he made unconditional offers to meet all his commitments and requested to set up a joint meeting. That he had the highest concern for the investors who were facing trauma of melting of their wealth caused due to completely avoidable panic. He reiterated that the long-term outlook was very bright and he had full faith in country’s economy and judicial system.

On 17.05.1992 itself he also addressed a letter to CBI even before any FIR was filed and sought meeting with them to extend complete co-operation and explain the transactions. He offered to secure the amounts as there was no intention to cause any losses. That adverse publicity was impairing the value of assets and offered to resolve all issues.

On 25.05.1992 he addressed a letter to Janakiraman Committee formed by the Government to seek its appointment and to follow-up on his offer to meet all his obligations.

On 26.05.1992 the Janakiraman Committee replied stating that it was not the function of the Committee to deal with the proposal of Harshad to secure repayment due to the banks and that he should take up the matters with the banks. He was also asked to supply information which have bearing on the reference given to the Committee.

On 02.06.1992 he addressed a letter to Dr. Manmohan Singh to make his unconditional offer and disclosed that there were outstanding transactions of about Rs.1100 Crores which were undertaken as per prevailing market practice. He stated that he has assets which he was willing to place in the custody of any bank or institution pending crystallization of the amounts so that the apprehensions about losses are quelled. He stated that he had large receivables and was separately approaching SBI and Grindlays Bank and offered himself to abide by any instructions. The copy of the above letter was also furnished to Hon’ble Minister of Banking, RBI Governor and Dy. Governor and CBI.

On 02.06.1992 he also addressed letters to SBI and Grindlays Bank to make his offers.

On 03.06.1992 he addressed a letter to the Janakiraman Committee in response to its reply dated 26.05.1992. He made a grievance that the problem exposure figure arrived at on the basis of records of the banks and without hearing him were highly exaggerated. That his money market assets of Rs.250 Crores deposited with NHB were not considered at all. That several banks had defaulted to him and he had substantial receivables from them. The Committee in its Report did not even mention that Harshad had already made unconditional offers to meet all his obligations.

On 26.10.1993 Harshad and all family members and corporate entities promoted by them filed before Hon’ble Special Court MA 215 of 1993 joining all the creditors and furnished a repayment plan to meet their claims which was not accepted by the banks and hence the said application was withdrawn. Even after demise of HSM I have made further efforts to discharge the obligations of HSM and offered reasonable terms but unfortunately even my subsequent efforts have failed because the banks were not giving credit for monies/assets owed by them to HSM and also wanted to charge heavy interest payable till repayment even after Hon’ble Special Court on 20.02.1995 laid down the law that no interest or penalty is leviable on solvent notified person post their notification. I am pleased to enclose a list giving particulars and summary of offers made by Harshad and me to our potential creditors to quickly resolve the issues and as per legal advice received by us such offers could have been made by us only on ‘Without Prejudice’ basis until the negotiated settlement was arrived at.

However, the public and the financial system fell prey to false reporting of Ms. Sucheta Dalal and hype and hysteria created by her to somehow bring the stock market down.

We are aggrieved that the regulators and investigating authorities instead of controlling/minimizing the damage has only magnified it and in fact competed with each other to exaggerate the problem exposure figures which caused havoc and a meltdown in prices and inflicted huge losses on the investors. It was falsely alleged that due to Harshad banks will suffer losses of Rs.5000 Crores but the real truth has since emerged that the banks have already been completely paid the principal amount of Rs.1716.07 Crores in respect of ex-parte decrees obtained by them though the decrees are for exaggerated amounts and they are challenged by me before Hon’ble Supreme Court. The above figures are exaggerated since no credit in regard to Harshad’s claim and counter claims have been given to him which will drastically reduce the problem exposure figure to less than even Rs. 500 crores. Conclusive facts have also emerged that several banks including NHB and SBI were found to be holding money market securities belonging to Harshad, many of which were confirmed by RBI in its letters addressed to the Custodian after undertaking inspection of several banks and its records. In several cases the securities belonging to Harshad yet remain pending to be recovered due to dishonest stands taken by the banks and collusion of Custodian with them by not recovering his assets and to take advantage of his sudden demise in jail on 30.12.2001.

An environment of distrust and fear psychosis was created in the money market and what was possible to be resolved immediately has remained unresolved till today due to litigation and an adversarial approach adopted by all the players. The payment which was offered by Harshad in 1992 to the banks has taken 30 years to be paid as the Income Tax department jumped in the fray and by acting mala-fide took away all the monies by making false claims so that Harshad is denied his surplus assets and return to the market. The banks also refused to resolve when Harshad once again filed MA 215 of 1993 before Hon’ble Special Court offering a plan of repayment as they wanted to even earn interest and claim damages from Harshad.

The Custodian and banks also colluded after the sudden demise of Harshad as instead of contesting the false claims of banks and securing credit for Harshad’s counterclaims or recovering his assets from them, the banks obtained ex-parte decrees bearing interest of 15% to 18% p.a. even though the law was laid down by Hon'ble Special Court duly upheld by Hon'ble Supreme Court that no interest or penalty should be levied on notified entities after attachment of their assets and their notification by the Custodian. While large amounts were deployed by the Custodian in Fixed Deposits earning 3% to 6% p.a. taxable interest or blocked with the IT department huge amount of Rs 3285.46 crores, the interest on decrees of 15% to 18% p.a. was allowed to run against Harshad so that he becomes liable to pay interest between Rs.30 to 50 lacs per day and in this manner, over the years he becomes bankrupt despite having complete ability to meet all his obligations ever since 1992. Because of enormous efforts made by me, now the entire principal amount of Rs.1716.07 Crores claimed by banks already stands paid to them and now we are very happy that we have fulfilled Harshad’s wishes.

From 2006 onwards I gradually discovered the fraud and mischief played by SBI and the Custodian acting in collusion with each other. Upon inspection of records I discovered that Rs. 590.83 crores which was already paid by Custodian to SBI was not accounted for and credit for the amount was deliberately not given even by SBI. Therefore I filed before Hon’ble Special Court MA 114 of 2007 against custodian to explain why the credit of such a large amount of Rs 590.83 Crores was not given by Custodian to Harshad and why SBI obtained ex-parte decree for higher amounts without giving the credit. The Custodian strongly opposed this application by filing 2 affidavits on 29.01.2008 & 30.05.2008 stating that no credit of Rs. 590.83 crores was required to be given to Harshad and the copy of my above application and Custodian’s replies are enclosed.

When I made serious allegations of fraud and collusion perpetrated by SBI and Custodian in my Civil Appeal filed before Hon’ble Supreme Court & when Hon’ble Supreme Court issued a notice to SBI under orders dated 18.10.2010, the SBI for the fear of being exposed after a lapse of eight years filed before Hon’ble Special Court MA 36 of 2011 and in para 23 & 24 of this Application offered to give credit to Rs. 592.49 Crores to Harshad retrospectively from 2003 onwards to cover 3 Civil Appeals filed by me. Following this on 15th of June 2011 SBI also addressed a letter to custodian behind my back to give credit of the above amount of Rs. 592.49 crores. The Custodian immediately changed his stand and revised the liabilities of Harshad which came down by more than Rs. 1500 crores taking into account even the effect of interest on the above amount Rs. 592.49 crores. This is only one of the examples of the fraud & collusion that has been perpetrated by SBI and Custodian to take full advantage of the sudden demise of Harshad and my inability to defend him for some years post his demise when ex-parte decrees obtained by SBI by active collusion and support of Custodian. The above Application and document are enclosed. I am therefore contesting the decrees before Hon’ble Supreme Court of above Rs. 1716.07 crores and I am hopeful of securing justice from the highest court of the land.

In the meantime, the investors who purchased the shares and held on to them have seen an abnormal appreciation in their value as was forecasted by Harshad and the shares purchased by our family members have also appreciated much more than the indices. The best evidence on the performance of our investments was adduced before Hon'ble Courts to counter the allegation of Custodian that how housewives could have investments running into crores and it was alleged that they were mere beneficiaries of diversion by Harshad to them. We demonstrably established that the investments made by two housewives viz. Smt Rasila Mehta and Smt Rina Mehta have appreciated much more sharply after Harshad’s demise on 30.12.2001 and therefore he had played no role in sharp appreciation of hundreds of crores. These housewives purchased shares at much lower cost and had paid both the brokerage and interest at normal rates to the 3 brokerage firms in the family. In support of our contention we have adduced 2 charts before Hon’ble Court. However a summary of sharp appreciation is presented below.

NAME | 31.03.2003 | 31.03.2007 | No of Times | 30.06.2011 | No of Times |

RASILA MEHTA | 48.17 | 243.54 | 5.06 | 413.42 | 8.58 |

RINA MEHTA | 42.17 | 197.26 | 4.68 | 353.44 | 8.38 |

The dormant portfolio of Smt Rasila Mehta appreciated by 5.06 times in a period of 4 years between 2003 to 2007 and by 8.58 times in 8 years and 3 months between 2003 and 2011 which is excluding the dividend income. In the case of Smt Rina Mehta, it is 4.68 and 8.38 times for the same period. The above conclusively vindicates the extremely bullish forecast made by Harshad and above results are achieved despite Sucheta bringing the markets down for almost 4 years.

Harshad always advocated stock selection based on research which we carried out extensively and on which basis he was extremely bullish on the future of this country and his vision and belief are proved right. No price rigging was done by Harshad except that he was early and perhaps alone and the market was not a bubble as falsely alleged by Ms. Sucheta Dalal, RBI Governor and others. The real power of Indian equity and intelligent investing can create enormous amount of wealth as demonstrated above. India is and will remain a heaven for investors and we must all put our savings by investing in the market and become prosperous. Harshad brought so many investors to the market by explaining its potential but all the good work done by him was reversed and undone by Ms. Sucheta Dalal who drove investors out of the market by creating false panic. It should be appreciated that this country needs capital for rapid growth and it can be supplied in abundance by domestic investors themselves in whose hands the wealth should be created instead of foreign investors reaping enormous gains. I am extremely happy to see that lot of savers are now taking to investing albeit after 30 years which will galvanize growth and reduce our dependence on the supply of capital by the foreigners and this will only ensure that the wealth so created remains within the country and in the hands of domestic investors. The modern day Kohinoor should remain property of Indians.

I say that Harshad’s defence is well-recorded in the interviews conducted by Shri Pritish Nandy which were put on YouTube and I am pleased to share the same. Besides that he made detailed presentations before the Joint Parliamentary Committee copies of which presentations dated 09.11.1992 and 19.04.1993 and a further letter to Chairman, JPC dated 17.07.1993 are also enclosed. Each of his assertions publicly made by him in 1992-93 are now proved to be totally true as can be easily verified from the facts and evidence now placed by me based on proved subsequent facts. Harshad neither committed any crime nor hurt any small investors but the true losses were only caused to them by Ms. Sucheta Dalal who sought to impose her views on the market by creating panic and bringing down the prices through self-fulfilling prophecy. She never deserved the Padma Shri awarded to her and Government ought to withdraw the same for putting this country and its investors behind by a few decades. The real tragedy is that she portrays herself as a paragon of virtue but has herself never abided by the rules of responsible journalism and ethics involved in it which were binding upon her. In fact, I am also pleased to share the relevant pages of code of conduct which responsible journalists are liable to follow but which code she breaks with impunity to earn personal glory and several perquisites which go along with it. She cannot champion the cause of the investors since she cannot truly forecast the market. Families like ours continue to suffer because of her opinionated writings through which she continues to encash monies by selling the rights of her book which is steeped in libellous writing.

In fact, Harshad had a constraint in granting interviews such as those given to Shri Pritish Nandy as several criminal cases were instituted against him and he was cautioned by the lawyers not to reveal his defence since criminal trials were still pending but Harshad was fearless and truly spoke his mind. He fearlessly asserted after his deposition before JPC that it was neither a securities scam nor stock scam but was truly a ‘Citibank scam’ which had systematically milked several Indian banks for years through its loyal set of brokers. This bank was maintaining more than one set of books and using the client’s account to part its own positions and I am happy to rely upon a detailed judgment of Hon’ble Special Court dated 18.09.1995 passed in MA 221 of 1993 delivered after a detailed trial and the findings against the bank were startling. I strongly recommend reading this judgment which is enclosed. It is because of hegemony of Citi bank that Harshad got big break-through from other banks who wanted to counter the monopoly of this foreign bank. The rapid success of Harshad was checkmated by some established players whose ego and reputation could not brook it and they formed a group to hurt him. Shri Manu Manek also became an informer and engineered a raid on Harshad by the IT department on 28.02.1992.

When Sucheta Dalal carried a story in TOI on 23.04.1992 without naming Harshad she already knew that there were no outstanding amounts payable by Harshad to SBI as within 4 working days by 21.04.1992 Harshad had already repaid Rs. 616.67 crores to SBI the details of which are given in the enclosed chart. The fact is admitted on pages 12, 13 & 14 of her book written with her husband titled “The Scam who won, who lost, who got away”. In fact, on 24.04.1992 the Chairman of SBI, Shri M.N. Goiporia publicly clarified through the Economic Times as under:

“that the reconciliation problem which had arisen regarding the purchase of Government securities by its investment department had been sorted out with the outstandings squared up. As of today, there are no outstandings”.

The relevant media clipping of the report in Economic Times dated 24.04.1992 is enclosed. If Ms. Sucheta Dalal was an honest and truthful journalist she would have corrected her false story of 23.04.1992 but she failed to do so because she was governed by mala fide object of finishing Harshad. Even in the above book Harshad is referred to as a scamster even though criminal trials were pending and he was not proven guilty by CBI. In fact SBI never filed any FIR against Harshad before CBI in respect of pending delivery of securities which only goes to prove that even as per SBI, the affected bank, no crime was committed by Harshad. But she gave a further twist by alleging that there should be a probe of how Harshad made the payment to SBI by raising monies from NHB. Ms. Sucheta Dalal had an obligation to first admit that her headline article of 23.04.1992 published in TOI reporting problem exposure of Rs.500 Crores was false to her own knowledge since on that day Harshad owed no monies to SBI but infact SBI owed some amount to him.

So biased was the trial by media which created huge hype and hysteria and vicious environment that every transaction of Harshad was given a colour of criminality and every crediting of cheque in his bank account was treated as an offence even though the Rules, Regulations and Bye-laws of BSE which governed Harshad permitted it as per a detailed analysis of it which is enclosed. Besides above, Harshad was offered “routing facilities” by several banks to undertake his transactions but this age-old market practice was overnight derecognized by RBI after allowing it for several years only after the alleged scam by issue of a Circular in this regard on 09.09.1992. In fact the Hon’ble Supreme Court also laid down the law through their judgment dated 19.03.1997 in the case of BOI Finance Ltd. vs. Custodian reported as (1997) 10 SCC 488 in terms of which the private and confidential circulars were only binding on the banks and not their customers and if the banks violated such circulars the same would not invalidate the contracts entered into by banks with its customers. That even otherwise the law always recognizes the customs, usages and prevalent market practices. Transactions that were completed by Harshad in which banks and PSUs had made profits and monies were already repaid, CBI still registered 21 criminal cases without the banks and PSU’s making any complaint in regard to them and in fact 21 out of 25 cases were registered by CBI without receiving any complaints from banks or PSU a list of which is provided. Unfortunately CBI never brought on record in its chargesheets the Bye-laws which were applicable to the brokerage firm of M/s. Harshad S. Mehta since they would prove that he had not committed any illegality much less any crime. The cases were multiplied even if no losses were incurred and all the transactions were fully performed by M/s. Harshad S. Mehta. CBI also proceeded on the basis that no amounts could have got credited into the account of M/s. Harshad S. Mehta though Bye-laws mandated it and routing facility permitted it.

Thus purely civil transactions were deliberately given a colour of criminality by Ms. Sucheta Dalal and thereafter by CBI completely ignoring the following:

That banks and PSUs in terms of Securities Contract Regulations Act, 1956 and as per the notification issued therein on 27.06.1969 could not undertake any transactions in listed Government securities, PSU Bonds and Units of UTI without engaging the services of a registered member of the stock exchange. Therefore, M/s. Harshad S. Mehta was engaged for undertaking such transactions.

That all contracts entered into by M/s. Harshad S. Mehta with banks and PSUs were reduced to writing and the same were strictly governed by the Rules, Regulations and Bye-laws of BSE framed in 1957 and the relevant Bye-laws are enclosed.

In terms of these Bye-laws, M/s. Harshad S. Mehta could transact on a principal-to- principal basis (self-account) and most of the transactions were entered into by M/s. Harshad S. Mehta on that basis. There was no legal requirement or necessity to disclose the counter party and in any case M/s. Harshad S. Mehta was the counter party. Only on the date of delivery M/s. Harshad S. Mehta used to provide the name of the delivering/receiving bank on his behalf and which was in accordance with Bye-law 81.

The Hon’ble Special Court has found that banks were entering into contracts with M/s. Harshad S. Mehta on a principal-to-principal basis but falsely showing him as a broker and some other bank as a counter party without paying any brokerage but CBI proceeded on the basis of records of the banks. List of orders of Hon’ble Special Court together with copies of the orders is enclosed.

That in terms of Bye-law 230, M/s. Harshad S. Mehta was not bound to accept any of the instructions or orders issued by its clients for completing the contracts and in terms of Bye-law 244 the banks had an option to close out any contract not performed by M/s. Harshad S. Mehta. As per Bye-law 159, if M/s. Harshad S. Mehta failed to deliver the security the client had a right to seek refund of money as sought by SBI on 11.04.1992. It is only in view of the above legal position the banks / PSUs did not file any criminal complaint against M/s. Harshad S. Mehta but CBI suo motu registered 21 cases.

The Hon’ble Special Court also took judicial notice of the fact that the banks were offering “routing facility” to brokers to undertake their transactions.

Once again in 2008, the Hon’ble Supreme Court in the case of S. Mohan Vs CBI reported as (2008) 7 SCC 1 held that charges of criminal breach of trust, conspiracy and of receiving stolen property cannot sustain if the banks did not file any criminal complaint and acquitted the accused.